Elevating Customer Service in Home Insurance with AI Interaction

Sadiah Zahoor, Research Scientist, Continuum Labs

The Intellicover project, a strategic initiative by our team at Continuum, represents a commitment to excellence in customer service within the home insurance industry. By harnessing the capabilities of the LLAMA-2 7B model, we have taken a data-centric approach to develop a conversational AI that can interact with the precision and understanding of an industry expert.This overview highlights key outcomes, including sophisticated conversational AI capabilities and the careful optimization of the model's performance.

Precision in Data Curation

The cornerstone of development of Intellicover was the creation of a dataset. Our journey began with the construction of a robust dataset, consisting of 1,000 dialogues reflecting the depth and breadth of customer interactions in the home insurance sector. This dataset was engineered to encompass a wide range of customer experiences, from routine inquiries to complex policy negotiations.

Fine-Tuning with LoRA

To enhance the AI's capabilities, we employed Low-Rank Adaptation (LoRA), a fine-tuning method that selectively adjusts the parameters of a pre-trained model. LoRA's elegance lies in its efficiency—it updates only a small subset of the model's weights, greatly reducing the computational resources required while maintaining the vast knowledge encoded in the pre-existing weights.

Evaluating Model Performance

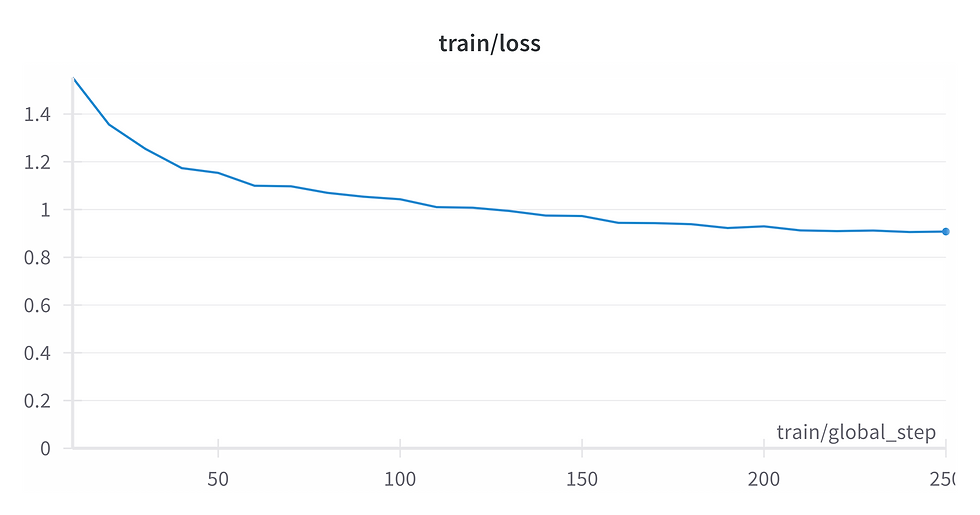

Our evaluation strategy included a rigorous analysis of loss metrics, where we closely monitored both training and evaluation loss. The training loss curve depicted a smooth descent, indicative of the model's increasing proficiency in generating contextually appropriate responses.

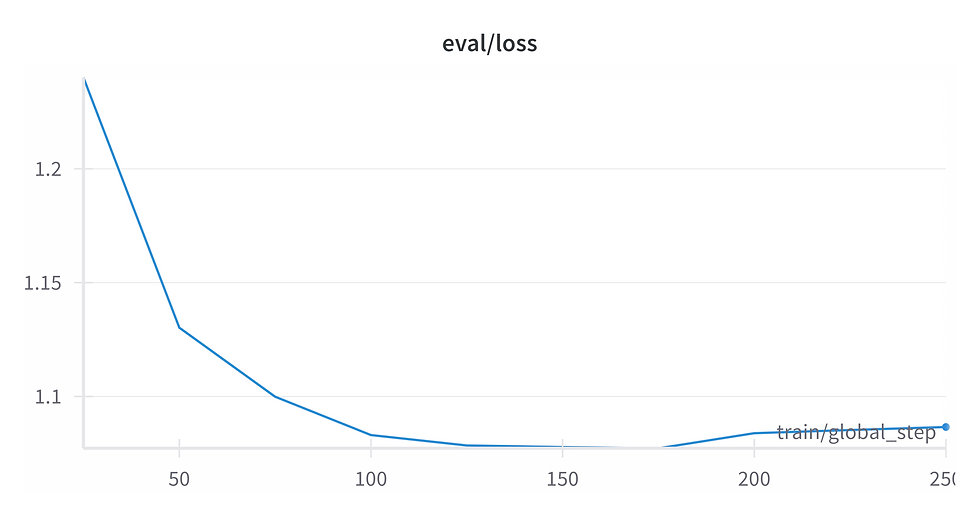

The evaluation loss graph is of particular interest. It demonstrates an initial sharp decline, suggesting that the model quickly assimilated the fundamental patterns in the data. This rapid decrease was followed by a plateau, a desirable trend indicating that the model had reached a state of equilibrium, balancing the acquisition of new knowledge with the retention of previously learned information.

We diligently selected the model's checkpoint at this plateau—the point where the evaluation loss ceased to decrease significantly—marking the model's optimal state for deployment. This careful selection ensures that the model, while trained to a high degree of accuracy, remains generalizable and avoids overfitting to the training data.

Learning Rate Scheduling

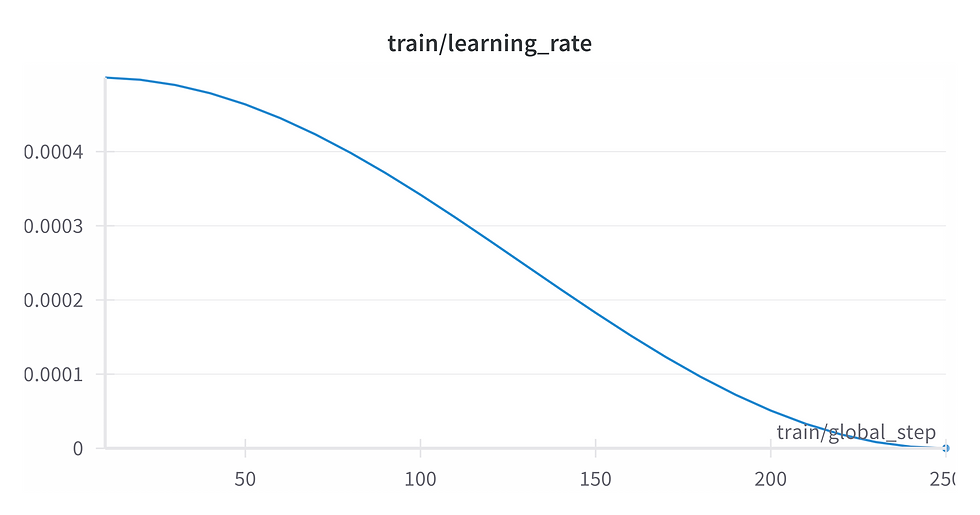

In tandem with monitoring loss, we applied a cosine decay schedule to the learning rate. This schedule began with a higher learning rate to capitalize on the model's initial rapid learning phase and gradually reduced it to allow for finer adjustments as the training progressed. The gradual tapering of the learning rate facilitated nuanced learning and prevented the model from overshooting the minimum of the loss function.

The Intellicover Experience

The culmination of these efforts is manifested in Intellicover's AI—a system not only equipped with the technical prowess to understand and respond to complex queries but also designed to engage with customers with the nuance and sensitivity of a human agent. This balance of technical sophistication and empathetic interaction is poised to set a new standard for customer service in the home insurance industry.

Here a brief interaction with insurance agent Alex at Intellicover.

You can start chatting with the Intellicover. Type 'quit' to exit.

You: Hi! I wanted to get fire insurance for my new flat.

Intellicover: Absolutely, I'd be happy to help you with that. My name is Alex, and I'm a salesperson with Intellicover, where we specialize in providing comprehensive property insurance, including fire insurance. It's essential to protect your home from potential risks, especially when you're moving into a new property. Firstly, I'll need to know a bit more about your new flat. What is the location, size, and type of property? Also, do you have any existing security measures in place? This information helps us tailor a policy that fits your specific needs. At Intellicover, we offer a range of fire insurance policies that cover various aspects of fire damage, including the structure of your home, your personal belongings, and even liability coverage if someone is injured on your property. We also provide support and guidance on how to prevent fire hazards in your home.

You: It is a one bedroom flat and located in the city. It will be rented out to students this fall.

Intellicover: Thank you for the information. Given that your new home will be rented out, it's important to ensure that the tenants are also covered under the policy. We can provide a landlord policy that includes both the building and the contents. For a one-bedroom flat in the city, we typically recommend a standard policy that covers the building structure, permanent fixtures, and personal belongings. However, we can adjust the coverage to meet your specific needs and the value of your investment. As a precautionary measure, I would suggest installing smoke detectors on every floor and in each bedroom. This not only helps prevent fire hazards but also makes your property more attractive to potential tenants.I can prepare a quote for you based on the information you've provided. Would you like me to include liability coverage as well?

You: Can you explain liability coverage?

Intellicover: Certainly! Liability coverage is an important aspect of fire insurance. It protects you from financial loss if someone is injured on your property and you are found legally responsible. For example, if a tenant or a visitor slips and falls due to a wet floor, liability coverage can help cover their medical expenses and any legal fees you might incur.Regarding the quote, I'll need to know the approximate value of your property and the contents you plan to keep inside. This will help us determine the appropriate level of coverage. I'll also need to know if you have any existing insurance policies that cover similar risks.Once I have this information, I'll prepare a detailed quote for you. It will outline the coverage options, the premium, and any deductibles or co-payments you'll need to make in case of a claim.

You: Cool. Yes, add it and send it via an email.

Intellicover: Great, I'll add that to my to-do list. I'll send you an email with the quote and all the necessary details. In the meantime, if you have any more questions or concerns, feel free to reach out.At Intellicover, we pride ourselves on providing transparent and comprehensive insurance solutions. Our goal is to ensure that you have peace of mind knowing that your new home is protected against potential risks. Once you review the quote, if you're happy with the coverage and the premium, you can proceed with purchasing the policy. We'll guide you through the entire process and make sure everything is set up correctly. Thank you for choosing Intellicover, and I look forward to helping you with your fire insurance needs. I'll send the email with the quote shortly. Thanks for your time!

Conclusion

The Intellicover project underscores our dedication to deploying advanced AI in a manner that is both technically sound and customer-centric. Through the strategic application of LoRA and meticulous analysis of training dynamics, we have created an AI that stands ready to deliver service of unparalleled quality to the home insurance sector. This initiative not only serves as a blueprint for future applications of AI in specialized domains but also as a benchmark for the level of service customers can expect to receive.

Comments